The Greatest Guide To Melbourne Finance Broker

Wiki Article

How Best Financial Planners Melbourne can Save You Time, Stress, and Money.

Table of ContentsGetting The Melbourne Finance Broker To WorkNot known Details About Best Financial Planner Melbourne The Main Principles Of Melbourne Finance Broker 7 Simple Techniques For Best Financial Planners MelbourneThe 10-Second Trick For Melbourne Finance Broker7 Simple Techniques For Best Financial Planners Melbourne

The selling of home loan financings in the wholesale or second market is a lot more common. They supply irreversible capital to the consumers. A "direct lender" might offer straight to a debtor, however can have the funding pre-sold previous to the closing. Few lending institutions are comprehensive or "portfolio loan providers". That is, couple of close, maintain, and solution the home loan.Even more, the mortgage broker would have to be extra certified with regulatory authorities. Home loan bankers and banks are not subject to this price decrease act. Since the selling of finances produces the majority of lender charges, servicing the total in a lot of instances exceeds the high cost act.

This is because of the delay of offering the servicing until after shutting. It is thought about a second market deal and not subject to the same law. Since 2007, in the United States the government regulation and the majority of state regulations do not appoint a fiduciary responsibility on home mortgage brokers to act in ideal passions of their customers.

Some mortgage brokers have been involved in home mortgage fraud according to the FBI.

Indicators on Best Financial Planners Melbourne You Need To Know

Most districts call for home mortgage brokerage firms to lug a rural certificate. Home Loan Brokers in Nova Scotia are certified by Service Nova Scotia and are regulated under the Mortgage Brokers and Lenders Enrollment Act.

While the terms Home mortgage Broker and Home mortgage Representative are comparable, and Home mortgage Brokers and Home loan Agents satisfy a lot of the exact same features, it is necessary note that there remains in reality a distinction. According to Canadian Home mortgage Trends the major difference in between a Mortgage Broker is that, "... a home mortgage broker is a company or person licensed to deal in home mortgages and use home loan representatives" while "A home loan agent is an individual accredited to handle home mortgages in behalf of a home mortgage broker.

Some home mortgage brokers charge a fee to their consumers.

The Ultimate Guide To Melbourne Finance Broker

The wider difference between consumers and companies embraced within the MCD is, in some aspects, in contrast to the present UK framework, and consequently some exemptions previously enjoyed in the UK will be terminated. One example is where customers or loved ones of consumers will certainly occupy less than 40% of a home, which is presently ruled out regulated service; by 2016, such debtors will be taken into consideration customers.

It is speculated that, because consumers' applications are stress-tested on the strength of their capability to make the monthly settlements, increasing varieties of debtors are going with mortgage terms exceeding the standard 25 years. This leads to lower settlements yet a greater total passion expense, in addition to a longer duration servicing financial obligation.

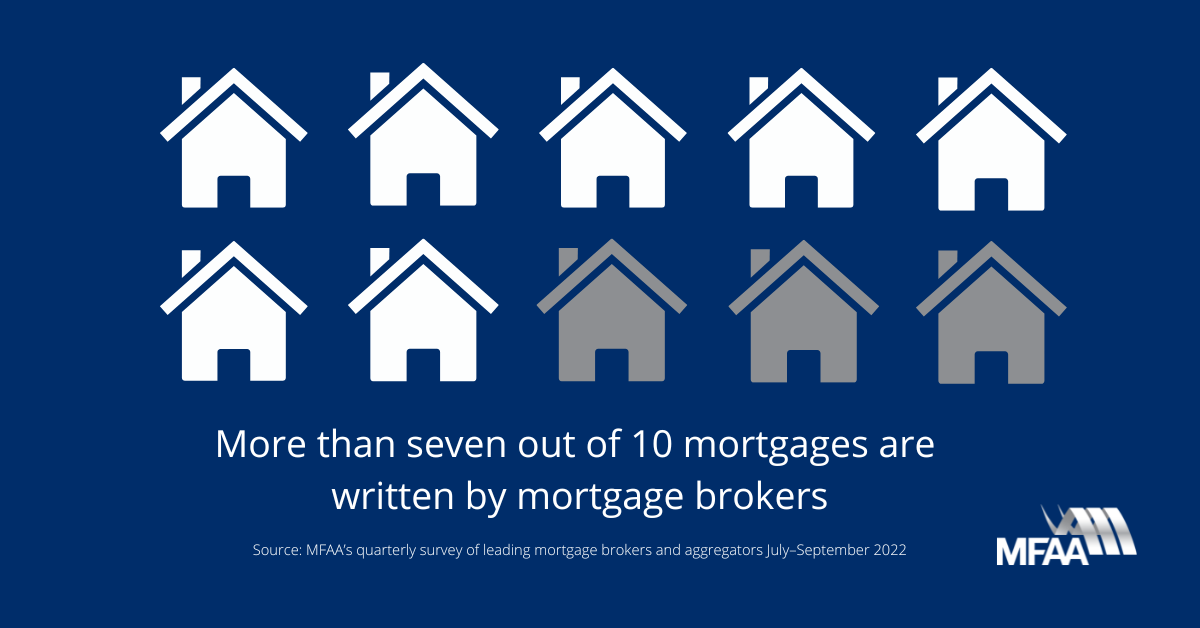

Roughly 35% of all loans safeguarded by a mortgage in Australia were presented by mortgage brokers in 2008.

8 Easy Facts About Melbourne Finance Broking Described

In 20162017, mortgage brokers had added to $2. 9 billion to Australian economic climate.165% of the car loan amount per year paid monthly. These commissions can differ considerably between different lenders and lending products, specifically because the payment re-alignments presented by Australian banks throughout June to August, 2008 in response to the Subprime mortgage dilemma. Although home loan brokers are paid payments by the lenders this does not modify the last rate or costs paid by the consumer as it might in other nations.

The quantity is usually 0. 66% of the loan amount for loans paid official site back in the initial 12 months and 0.

The broader difference in between customers and companies adopted within the MCD is, in some respects, in contrast to the current UK framework, and because of this some exceptions previously appreciated in the UK will be eliminated (finance brokers melbourne). One instance is where customers or loved ones of borrowers will inhabit much less than 40% of a building, which is currently More Help ruled out controlled company; by 2016, such consumers will be taken into consideration consumers

Things about Best Financial Planner Melbourne

It is hypothesized that, since borrowers' applications are stress-tested on the toughness of their ability to make the regular monthly settlements, raising numbers of debtors are deciding for mortgage terms going beyond the conventional 25 years. This causes lower settlements yet a greater overall interest costs, as well as a longer period servicing financial debt.About 35% of all financings safeguarded by a home loan in Australia were presented by home loan brokers in 2008.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

165% of the car loan quantity per annum paid monthly. These commissions can differ considerably in between different lending institutions and finance products, specifically because the payment re-alignments introduced by Australian financial institutions during June to August, 2008 in response to the Subprime mortgage dilemma. Although mortgage brokers are paid payments by the lenders this does not modify the final rate or charges paid by the customer as it might in other nations.

How Best Financial Planner Melbourne can Save You Time, Stress, and Money.

The amount is usually 0. 66% of the lending amount for loans paid back in the first 12 months and 0.Report this wiki page